What are the three main types of leases?

Table Of Contents

Gross Leases

In a gross lease, the landlord assumes most of the operating expenses associated with the property. This arrangement typically includes costs such as maintenance, property taxes, and insurance. Tenants benefit from the simplicity of a single rental payment without worrying about fluctuating expenses. It offers a predictable monthly budget that can aid in financial planning.

Landlords, on the other hand, gain a steady revenue stream with less administrative burden related to managing property expenses. They can maintain control over the property while ensuring that the lease terms remain stable. The gross lease format often appeals to both parties, providing a straightforward leasing experience that fosters long-term relationships.

This is an essential article for anyone looking to learn more about the topic.

Benefits for Tenants and Landlords

Tenants benefit from gross leases through the simplicity and predictability of their financial obligations. With a fixed monthly rent that includes all property expenses, tenants can better manage their budgets without worrying about unexpected costs. This arrangement also streamlines communication, as they deal with a single payment rather than multiple bills for utilities and maintenance.

Landlords, on the other hand, appreciate the consistent cash flow that gross leases provide. Having a set rental income allows for easier financial planning and minimizes the administrative burden of tracking individual expenses. This lease type can also attract tenants looking for hassle-free living arrangements, potentially leading to lower vacancy rates and a more stable tenant base.

Percentage Leases

In a percentage lease, a tenant’s rent is based on a percentage of their business revenue, making it a common arrangement in retail and commercial real estate. This type of lease often includes a base rent along with a percentage of gross sales, balancing risk between landlord and tenant. It allows landlords to benefit from the tenant's business success while providing tenants with a potentially lower fixed cost at lease commencement.

Revenue sharing can create a more adaptive financial structure for both parties. During slower business periods, tenants may face lower costs, easing financial strain. Conversely, in booming periods, the landlord enjoys increased earnings through the percentage of sales. This mutually beneficial arrangement fosters a collaborative relationship where both parties are incentivized to ensure the business thrives.

How Revenue Sharing Works

In percentage leases, landlords receive a base rent plus a percentage of the tenant's revenue. This arrangement directly ties rental costs to business success, creating a shared interest in the property’s performance. For instance, if a tenant operates a retail store, their rent might include a set monthly fee along with an additional charge based on monthly sales. This model encourages both parties to work together to maximize sales and, consequently, rental income.

This type of lease is commonly favored in industries like retail and hospitality, where sales can fluctuate significantly. It allows landlords to benefit from increased sales while providing tenants the flexibility to manage cash flow. As sales rise, the rent increases correspondingly, and during slower periods, tenants face a lower fixed cost. This symbiotic relationship can ultimately lead to long-term stability for both landlords and tenants.

Lease Options

Lease options offer a unique structure that provides both tenants and landlords with flexibility. With this type of agreement, tenants have the right to purchase the property at a predetermined price within a specific timeframe. This arrangement can be beneficial for tenants who may want to test a location before committing to a long-term purchase, allowing them to secure a future investment while navigating their current living situation.

Landlords can also find advantages in lease options. These agreements can attract potential buyers who might not be ready to commit immediately but are interested in the property. Additionally, they can generate steady rental income over the lease term while maintaining the potential for a sale. This dual benefit can make lease options a compelling choice for both parties engaged in the real estate market.

Flexibility in Leasing Agreements

Lease options provide a unique advantage for both tenants and landlords by allowing various arrangements depending on their specific needs. Tenants often appreciate the ability to lock in rental prices for a specified period while maintaining the option to purchase the property later. This flexibility can be particularly beneficial in fluctuating real estate markets where prices may rise, thus offering potential savings.

Landlords also benefit from lease options, as they may attract a broader tenant base looking for short-term commitments with the possibility of buying the property. This arrangement can reduce vacancy rates, ensuring consistent income while creating opportunities for property appreciation. Additionally, it creates a sense of investment for tenants, who might be more inclined to care for the property.

FAQS

What is a gross lease?

A gross lease is an agreement where the landlord covers all operating expenses, including property taxes, insurance, and maintenance costs, while the tenant pays a fixed rent amount.

What are the benefits of a gross lease for tenants?

Tenants benefit from predictable monthly expenses, as they only need to budget for the fixed rent without worrying about fluctuating operational costs.

What is a percentage lease?

A percentage lease is a type of lease where the tenant pays a base rent plus a percentage of their revenue, typically applicable in retail settings. This structure aligns the interests of both the landlord and tenant, as the landlord benefits from the tenant's success.

How does revenue sharing work in a percentage lease?

In a percentage lease, the tenant pays a base rent plus an additional fee calculated as a percentage of their sales revenue, incentivizing both parties to maximize sales for mutual benefit.

What is a lease option?

A lease option is a leasing arrangement that gives the tenant the right, but not the obligation, to purchase the property at a predetermined price during or at the end of the lease term.

What are the advantages of lease options for tenants?

Lease options provide tenants with flexibility and the opportunity to secure a property without an immediate commitment to purchase, allowing them time to assess the property's suitability and market conditions.

Related Links

What are the 5 criteria for a lease?Are printer leases worth it?

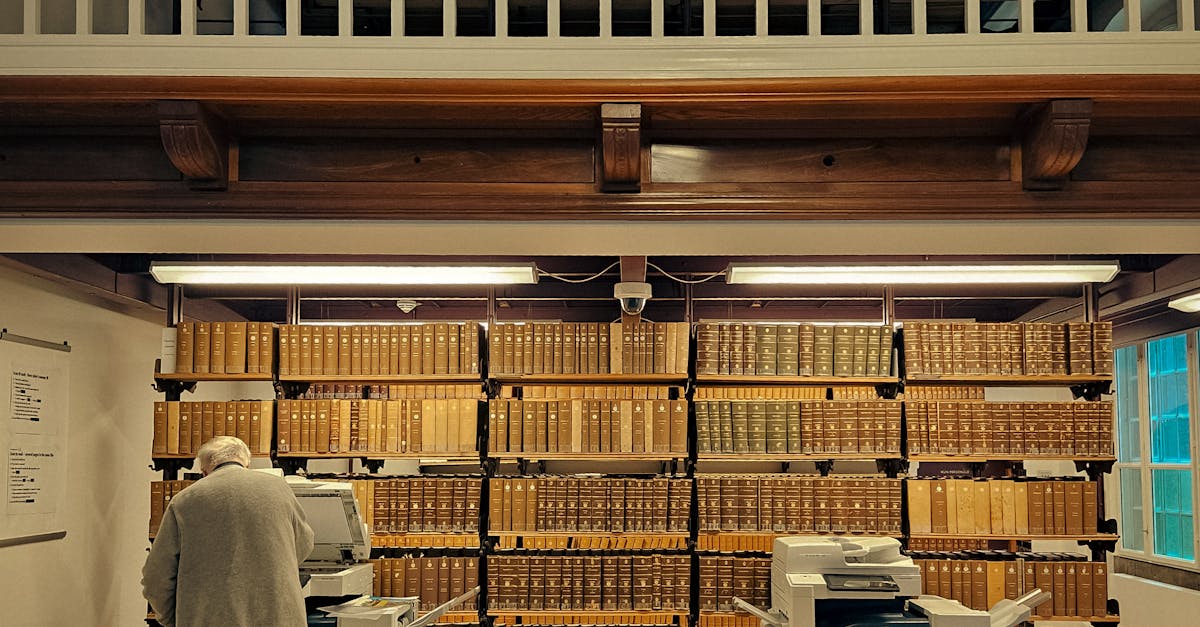

How do copier leases work?

What is the downside of an ink tank printer?

How much does it cost to lease a Xerox printer?